What The He#! happened to Silicon Valley Bank (SVB) :/ ?? Venture Backed Startups Scramble.

Silicon Valley’s best friend / bank got caught in some sort of a mess. Here's what we're piecing together

First there was SBF - Sam Bankman Fried and the demise of FTX. The Fintech Crypto alternative finance world implodes.

Now we have news that Silicon Valley’s best friend / bank got caught in some sort of a mess that has caused the FDIC (Federal Deposit Insurance Corporation) to step in an take over the bank.

What caused this collapse?

We’re trying to piece it together but in part many Venture Capital backed founders were directed by their funders- Founders Fund, Union Square Ventures and Coatue Management to pull their money out.

This allegedly caused a bank run.

Silicon Valley Bank shares plunged 60% Thursday after disclosing that it needed to shore up its capital with a $2.25 billion equity raise from investors including General Atlantic. The company’s stock was down another 60% in premarket trading Friday.

SVB’s collapse has led to cash crunch for startups globally. Y Combinator CEO Gary Tan describes this as an “extinction level event” for startups worldwide.

Meanwhile accolades for Silicon Valley Bank (you might keep seeing SVB being brandished around) keep pouring in.

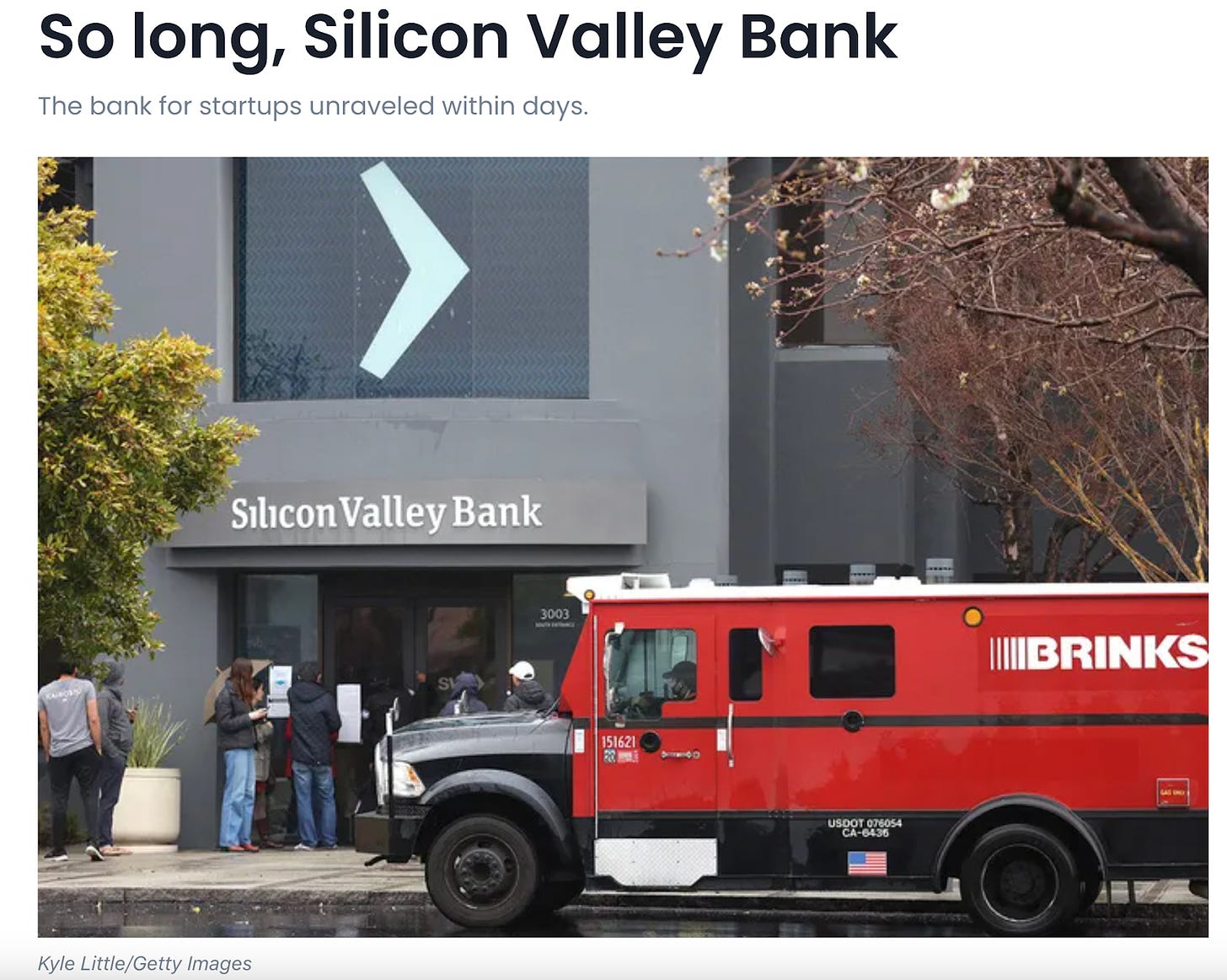

Morning Brew bid the institution good bye.

ChatGPT what's your take?

In February 2023, Silicon Valley Bank (SVB), a major US bank that primarily serves technology companies and their investors, faced a financial crisis due to a combination of factors including loan defaults and exposure to risky investments.

As a result, the bank was at risk of becoming insolvent, which means it would not have had enough assets to cover its liabilities, including customer deposits.

Since the Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 per account, depositors with accounts below that amount would have been protected. However, depositors with accounts over $250,000 were at risk of losing their money if the bank failed.

To prevent this from happening, the FDIC stepped in and took over the bank, which means that the FDIC became the owner of the bank and all its assets and liabilities.

The FDIC is now working to find another bank to acquire SVB, which would allow the bank's customers to continue their banking services without interruption.

It's worth noting that SVB's customers are primarily businesses, not individuals, and the bank's failure would have had significant implications for the tech industry, which relies heavily on SVB's services.

Therefore, the FDIC's intervention was aimed at preventing a broader financial crisis that could have had serious economic consequences.

As stated earlier, the run began when a powerful Silicon Valley VC, Peter Thiel’s Founders Fund, advised its portfolio companies to withdraw their money from SVB.

According to Fast Company — and other publications like Fortune, Bloomberg this is what kicked the final demise to ensue.

According to these sources other VCs soon caught wind of the advisory and began advising their own portfolio companies to withdraw funds from SVB.

The withdrawals accelerated, and the bank began taking steps to stem the tide and preserve its solvency.

SVB specializes in serving tech startups and has suffered from the downturn of the general tech economy that started last year.

However, the bank had plentiful assets, but they were not liquid assets that could be paid out immediately.

The final act of the drama was a surprisingly fast intervention by regulators who took over the bank.

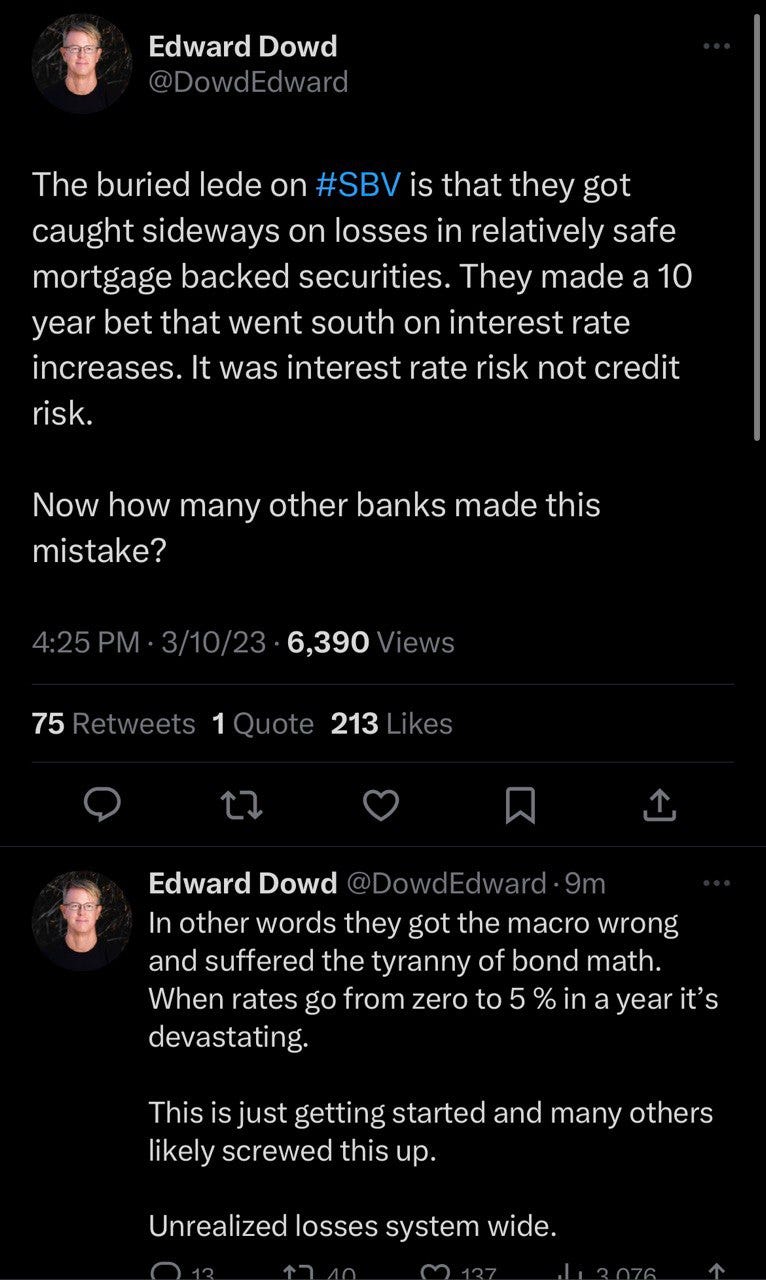

Silicon Valley Bank experienced rapid growth in total deposits and assets between 2020 and 2021, investing much of the money in bonds.

The bank suffered losses of $1.8 billion due to the souring value of these bonds and attempted to raise capital by selling $2.25 billion worth of stock but fell short.

California's Department of Financial Protection and Innovation has shut down Silicon Valley Bank, and the Federal Deposit Insurance Corporation will handle its reopening and reimburse any insured deposits' losses.

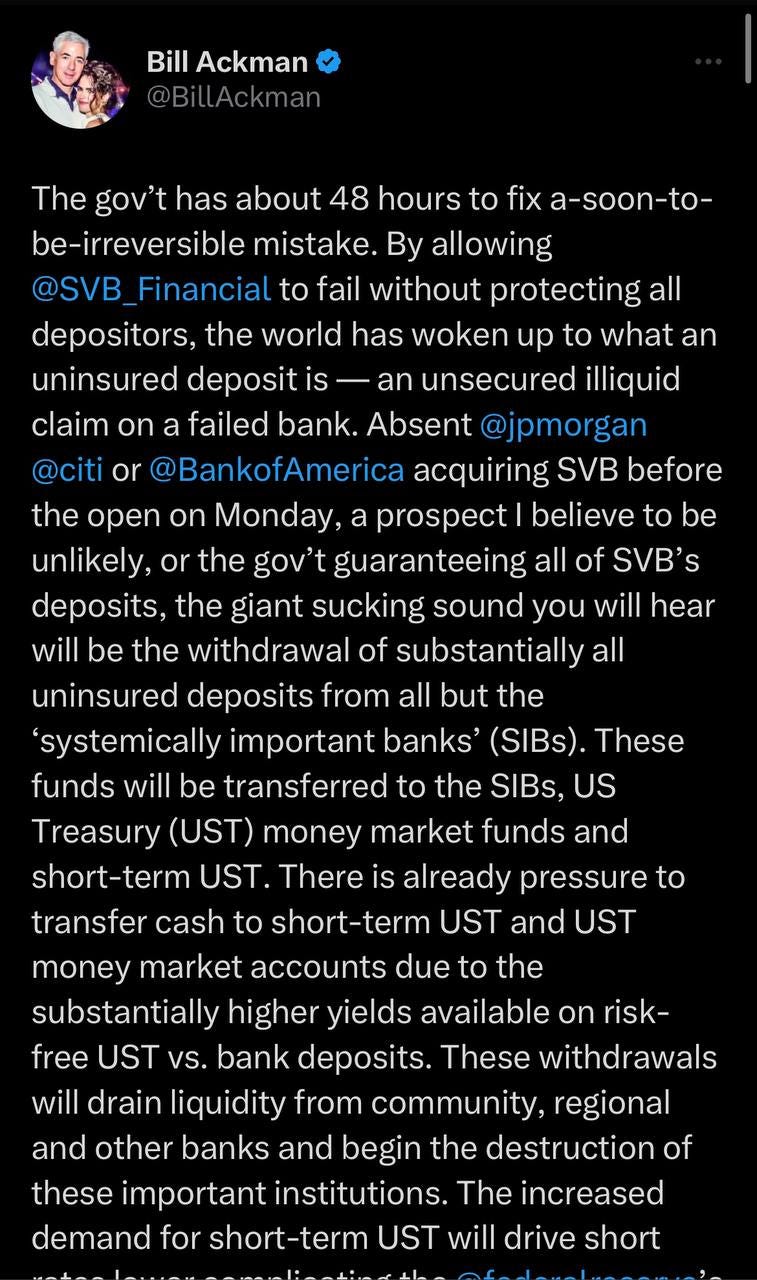

Investors are concerned that similar, undercapitalized banking outfits like First Republic, PacWest, and Signature Bank could be under pressure as well.

The fallout from Silicon Valley Bank's failure is affecting other financial institutions, with shares of online lenders SoFi Technologies and Upstart Holdings also dropping.

Meanwhile Bing Continues to give impressive monkey answers

In lockstep, Crypto lender Silvergate Capital also blew up.

Silvergate Capital, one of the top banks in the crypto market, is winding down and returning all deposits after a bank run forced it to sell off assets at a steep loss to cover billions of dollars in withdrawals.

The California lender, which opened up to crypto companies in 2014 and saw a dramatic increase in deposits, is now considering how to resolve claims and preserve the residual value of its assets.

Billionaire investor Peter Thiel, who bet that Silvergate could weather the crypto storm, is among the investors who will now be appraising losses.

This might be the best description of what is going to happen to customers that still have money tied up in the bank.

Majority of accounts with over $250k are owned by businesses, not individuals.

The FDIC is legally required to cover up to $250k, but they try to find another bank to buy the failing bank and make all depositors whole.

The FDIC usually does not have to put in a lot of money and charges banks higher insurance premiums to cover any gaps.

The FDIC is not likely to bail out SVB deposit holders and will make equity holders and lenders eat the losses.

Another bank may be willing to buy a failing bank because they will acquire a lot of customers for free.

Our hearts for sure go out to founders and Silicon Valley Bank employees who are being affected by this.

None of this is good.

What comes next?

Monday.

Cheques (‘Checks’ in American) should again start to clear as the FDIC set up a new bank to handle the SVB accounts called the Bank of Santa Clara.

Any account over $250k though is likely frozen.

It is possible a new owner will emerge quickly as the FDIC will act as referee and steward seeking a new owner to recapitalize and make depositors- not shareholders - they’re toast- whole.

There are 8 million Fintechs out there, aren’t they ready to save startups from the traditional banking route they are suddenly fleeing to? Doesn’t seem like it.

Our partner in the Founders Dinner Pacific Western Bank - the number two venture bank to Silicon Valley Bank might be worth checking out.

DM us on Twitter if you want a connection to PacWest

🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖🤖 Sponsorship »»»

Hire talented staff that cost 80% less than US based equivalents

Are you a business owner who is feeling the pain of having to find quality talent while needing to stay on budget?

Yes. We've all been there. This is where Remotely Talents can help.

Their team specializes in sourcing A+ Ukrainian professionals for way less than US equivalents - 40-80% less. From accounting to TikTok ads, they've got your back!

Plus 3% of all sales goes towards aiding a National Children's hospital in Ukraine - an incredible mission set forth by founder Adomas Pranevicius

Go to Remotely Talents right now and start a conversation.